The newswires have covered the recently tabled Federal Budget 2025 and not without its drama of defections and resignations from the PC party. This places the Liberal government one vote away from passing the budget. The final vote for the budget is Monday, November 17th, 2025.

Here, we have tried to distill the 493-page ‘beast’ of a budget document into a meaningful way for the Mining Supply and Services (MSS) sector.

Without duplicating effort, our friends at the Mining Association of Canada (MAC) have done a great job on highlighting what the federal budget intends to do to support the Canadian mining ecosystem. You can find this summary at this link HERE.

Below, MSTA CANADA will focus on the trade, export, and manufacturing support in the 2025 budget.

Trade Diversification and Infrastructure Investment

The new Trade Diversification Strategy wants to double non-U.S. exports over the next ten years, targeting an additional CAD $300 billion in trade. By diversifying export markets beyond the U.S., Canada aims to reduce vulnerability to trade shocks, tariff risk, or over-reliance on a single partner. Achieving the goal of doubling non-U.S. exports is ambitious — success depends on firms being able to access this support easily, to scale, to offer supplies and services competitively, and to overcome any market-entry obstacles.

Key Measures for Infrastructure

-

A Trade Diversification Corridors Fund: CAD $5 billion over seven years starting 2025-26 for transportation/trade-infrastructure (ports, rail, airports) and to open up overseas markets.

-

Arctic Infrastructure Fund: $1 billion allocated over four years, starting in 2025-26, to Transport Canada, which will invest in major transportation projects in the North with dual-use applications for civilian and military use, including airports, seaports, all-season roads, and highways.

Why This Matters

The infrastructure investment will help Canadian exporters access new global markets by reducing logistical/trade barriers.

Caveats & Considerations

Infrastructure investments have long lead-times; benefits may take years to fully materialize.

Manufacturing and Industrial Development

Key Measures for Manufacturing

-

Introduction of a “Productivity Super-Deduction” including immediate expensing (100% first-year write-off) of manufacturing or processing machinery and equipment.

-

Immediate expensing for manufacturing or processing buildings (for buildings used by manufacturing/processing businesses) for property acquired on or after Budget Day and first used before 2030.

-

Reinforcement of the Scientific Research and Experimental Development (SR&ED) tax incentive program with enhancements to support business R&D.

-

Support for the new industrial/strategic manufacturing agenda — an “industrial development” budget of approx. CAD $270 billion over five years.

-

Tax measures and targeted credits designed to lower the cost of capital for firms investing in manufacturing assets in Canada.

Why This Matters for Manufacturing

-

Capital investment becomes more attractive: Immediate deductions lower effective investment costs.

-

Boosting competitiveness and productivity: Encourages modernization of manufacturing facilities.

-

Supporting advanced sectors: Aligns with Canada’s shift toward clean-tech and advanced manufacturing.

-

Reducing investment risk & strengthening domestic capacity: Encourages capital inflows and job creation.

-

Time-sensitivity/incentive for near-term action: Deductions apply to property acquired after Budget Day and used by a certain date.

Caveats & Considerations

-

Measures are primarily tax incentives, not direct grants.

-

Building expensing is temporary and subject to phase-out.

-

Non-tax barriers (labour, supply chain, regulation) persist.

-

Benefits depend on execution, eligibility, and firm readiness.

Small and Medium-Sized Enterprises (SMEs)

Key Measures for SMEs

Export-support programs and agencies:

-

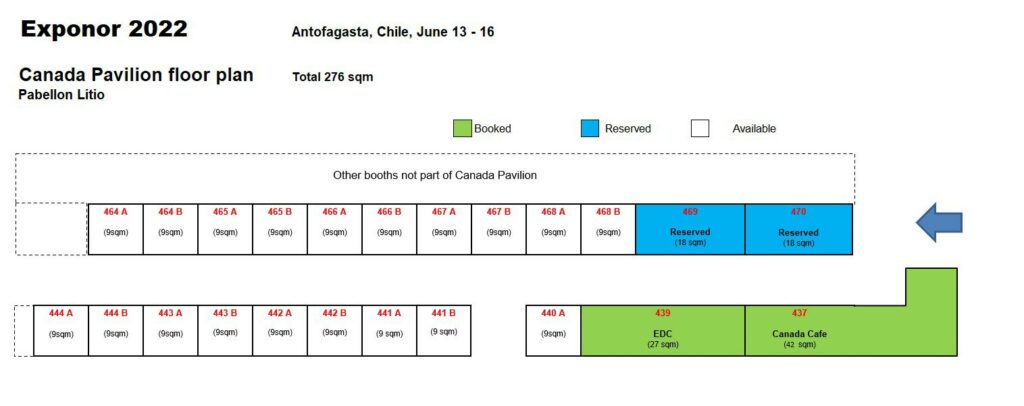

EDC tasked with increasing its business-facilitated volume by CAD $25 billion by 2030.

Funding for export readiness and capacity-building:

-

CAD $68.5 million for enhanced CanExport.

-

CAD $46.5 million for the SME Export Readiness Initiative.

-

Focus on trade with the Indo-Pacific and Europe to diversify markets.

-

Modernization of export processes (digital trade tools).

-

Targeted support for sectors impacted by U.S. trade pressures.

Tax and investment incentives:

-

Enhancements to SR&ED — expenditure limit increased from CAD $3M to $4.5M, plus $440M ongoing to catalyze private-sector R&D.

-

Extended IP-support programs:

-

Elevate IP — CAD $84.4M over four years (starting 2026-27).

-

Innovation Asset Collective Patent Collective — CAD $22.5M over three years.

-

Why This Matters for SMEs

-

Helps smaller firms expand internationally, not just large exporters.

-

Reduces barriers to export growth and strengthens innovation capacity.

-

Improves SME competitiveness in global supply chains.

-

Expands access to capital and incentivizes near-term investment.

-

Encourages a broader base of SMEs to engage in export and innovation activity.

Caveats & Considerations

-

Many measures start in 2026–27 or later, delaying short-term impact.

-

Focus on Asia/Europe may overlook mineral-rich partner regions.

-

IP process costs may still outweigh benefits for smaller firms.

-

Labour, supply-chain, and digital barriers remain unresolved.